The first Certificate of Entitlement (COE) bidding exercise for 2025 concluded on January 8, 2025, setting the stage for another dynamic year in Singapore’s vehicle market. Premiums across most categories have risen, reflecting strong demand and tight supply.

This article provides an in-depth analysis of the latest COE results, explores the factors driving price increases, and discusses the implications for the year ahead.

Table of Contents

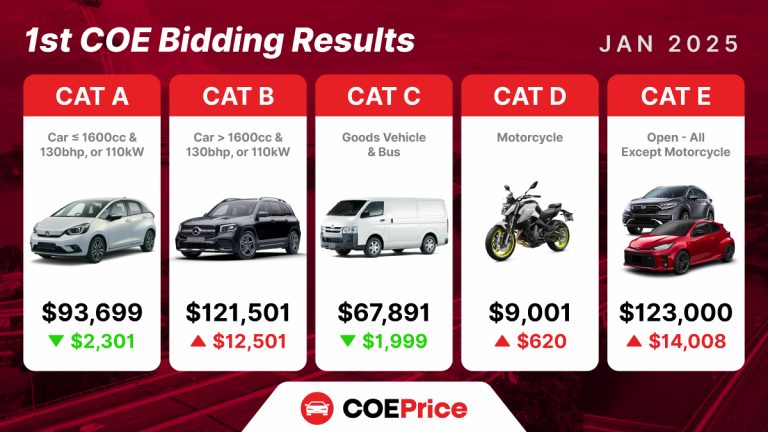

Key Highlights from the January 2025 COE Results

Category A (Cars 1,600cc & Below or 130bhp & Below)

- Premium: $93,699 (down by $2,301 from December 2024).

- Quota: 1,034 (down by 1).

- Bids Received: 1,381 (down by 125).

- Insight: Despite a decrease in premium and bids, small cars remain popular due to their affordability and practicality. The sustained demand suggests that these vehicles are still a viable choice for many consumers.

Category B (Cars Above 1,600cc or 130bhp & Above)

- Premium: $121,501 (up by $12,501 from December 2024).

- Quota: 677 (up by 1).

- Bids Received: 1,266 (up by 279).

- Insight: The significant increase in premiums reflects strong demand for larger cars and electric vehicles, driven by government incentives and the maturing EV infrastructure. The rise in bids indicates heightened competition in this category.

Category C (Goods Vehicles and Buses)

- Premium: $67,891 (up by $1,999 from December 2024).

- Quota: 248 (down by 7).

- Bids Received: 364 (down by 36).

- Insight: Despite a reduction in quota and bids, the premium increase suggests steady demand from businesses for commercial vehicles, possibly due to economic activities or logistics needs.

Category D (Motorcycles)

- Premium: $9,001 (up by $620 from December 2024).

- Quota: 520 (up by 1).

- Bids Received: 595 (down by 46).

- Insight: The modest increase in premiums, despite a decrease in bids, indicates ongoing interest from delivery services and cost-conscious individuals, highlighting the affordability and utility of motorcycles.

Category E (Open Category, All Except Motorcycles)

- Premium: $123,000 (up by $14,008 from December 2024).

- Quota: 191 (up by 9).

- Bids Received: 415 (up by 85).

- Insight: The largest premium increase reflects robust demand for high-end vehicles, possibly driven by luxury car preferences and the growing appeal of electric vehicles in this segment.

Why Are COE Prices Increasing?

- Premium Trends: Premiums are generally increasing across most categories, indicating sustained demand and competition, except for Category A, where premiums have decreased.

- Demand Dynamics: The shift towards electric vehicles is evident in Categories B and E, influenced by government policies and consumer preferences for sustainable transportation.

- Economic and Regulatory Factors: Economic conditions, such as inflation and interest rates, along with government regulations, play significant roles in shaping COE premiums and market dynamics.

- Future Outlook: Rising premiums may encourage consumers to explore alternatives like public transportation or shared mobility solutions. The automotive industry is likely to focus on premium and electric vehicles to meet changing demands.

Implications for 2025

- Affordability Concerns

With premiums edging closer to six-figure sums across the board, owning a vehicle in Singapore becomes increasingly aspirational rather than practical for many. This may drive further interest in alternatives like ride-sharing and public transport. - Policy Adjustments

As COE prices soar, policymakers may need to consider quota adjustments to manage affordability and accessibility concerns. The planned injection of up to 20,000 additional COEs from February 2025 could provide some relief, though its impact remains uncertain. - Growing EV Adoption

Expect Categories B and E to remain hotly contested as more EV models enter the market. Government incentives and infrastructure development will continue to shape this trend.

Navigating the COE Landscape

The January 2025 COE results underscore Singapore’s unique vehicle ownership landscape, where regulatory measures heavily influence market behavior. For prospective buyers, careful planning is essential to navigate the rising costs.

Meanwhile, businesses and policymakers must continue balancing sustainability, accessibility, and affordability as Singapore transitions into a greener transportation ecosystem in 2025 and beyond.