As the final Certificate of Entitlement (COE) bidding exercise for 2024 concluded, Singapore’s vehicle market witnessed notable shifts. With premiums rising across most categories except commercial vehicles, the trends shed light on the evolving dynamics of supply, demand, and buyer behavior. This coe bidding exercise sets the tone for what could unfold in 2025.

Table of Contents

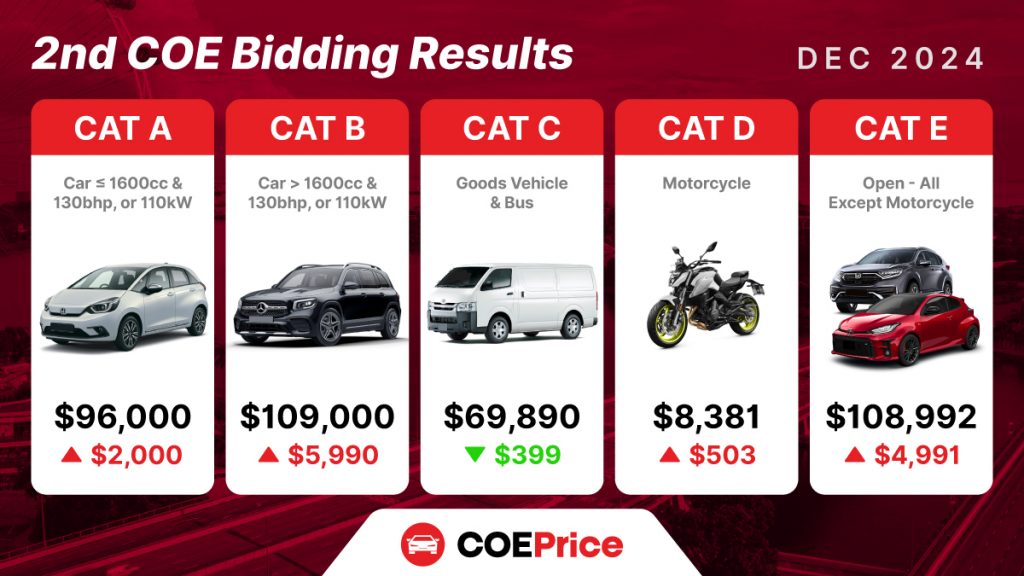

Key Highlights from the December 2024 COE Results

- Category A (Small Cars, 1,600cc and Below)

- Premium: S$97,000 (up 4.3% from S$93,000).

- Insight: This category has seen steady demand as small cars remain popular for their affordability and practicality. However, a near-S$100,000 premium pushes these vehicles further into luxury territory, reflecting constrained supply and consistent demand.

- Category B (Large Cars and Electric Vehicles)

- Premium: S$109,000 (up 5.8% from S$103,010).

- Insight: The rise in this category underscores sustained interest in larger vehicles, including electric cars. Growing EV adoption likely plays a role, supported by government incentives and a maturing EV infrastructure.

- Category C (Commercial Vehicles and Goods Vehicles)

- Premium: S$69,890 (down 0.6% from S$70,289).

- Insight: A marginal drop suggests stable demand in this category, as businesses may be moderating fleet expansion amidst economic uncertainties.

- Category D (Motorcycles)

- Premium: S$8,381 (up 6.4% from S$7,878).

- Insight: The largest percentage increase across categories highlights growing interest in motorcycles, possibly driven by affordability and rising demand from delivery services.

- Category E (Open Category, Transferable Across Vehicles)

- Premium: S$108,992 (up 4.8% from S$104,001).

- Insight: The open category, often linked to luxury cars, mirrors trends in Category B, indicating robust demand for premium vehicles.

Why Are COE Prices Increasing?

Several factors contributed to the upward trend in premiums:

- Seasonal Year-End Rush

The year-end always sees heightened activity as buyers aim to secure vehicles before the new year. This seasonal behavior drives demand, especially in Categories A and B. - Constrained COE Supply

COE quotas remained tight, reflecting broader government policy aimed at controlling vehicle population growth. Limited supply naturally intensifies bidding competition. - EV Momentum

With Singapore’s push towards electrification, many buyers are entering the market for electric vehicles. This trend adds pressure to Category B and E premiums. - Persistent Inflationary Pressures

Rising costs of vehicles and financing continue to push buyers to secure COEs sooner, fearing further price hikes in the future.

Implications for 2025

Looking ahead, the COE market faces several challenges and opportunities:

- Affordability Concerns: With premiums edging closer to six-figure sums across the board, owning a vehicle in Singapore becomes increasingly aspirational rather than practical for many. This may drive further interest in alternatives like ride-sharing and public transport.

- Policy Adjustments: As COE prices soar, policymakers may need to consider quota adjustments to manage affordability and accessibility concerns.

- Growing EV Adoption: Expect Categories B and E to remain hotly contested as more EV models enter the market.

Navigating the COE Landscape

The December 2024 COE results are a testament to Singapore’s unique vehicle ownership landscape, where regulatory measures heavily influence market behavior. For prospective buyers, careful planning is essential to navigate the rising costs.

Meanwhile, businesses and policymakers must continue balancing sustainability, accessibility, and affordability as Singapore transitions into a greener transportation ecosystem in 2025 and beyond.

Why have COE prices changed compared to the previous exercise?

COE prices shift based on the interplay of supply and demand. Key factors that may have influenced the 18 December 2024 results include:

Increased Demand for Larger Vehicles: The premium for Category B COEs—designated for larger, more powerful cars and electric vehicles—rose by 5.8% to S$109,000 from S$103,010 in the previous exercise, indicating heightened interest in this segment.

Rising Motorcycle Premiums: Category D, covering motorcycles, experienced the largest increase of 6.4%, with premiums reaching S$8,381, up from S$7,878, suggesting a surge in demand.

Stable Commercial Vehicle Segment: Category C, for goods vehicles and buses, saw a slight decrease of 0.6% in premiums, settling at S$69,890 compared to S$70,289 previously, indicating a balanced demand and supply in this sector.

Year-End Market Behavior: As the year-end approaches, buyers often rush to secure vehicles before the new year. This seasonal pattern can elevate demand and, consequently, COE prices.

Will COE prices continue to rise in 2025?

Predicting future trends is challenging, but the high Cat B and Cat E prices may continue if the appetite for premium vehicles remains strong and COE quotas stay limited. Conversely, any policy adjustments by the Land Transport Authority (LTA), economic shifts, or changes in consumer sentiment could stabilise or reduce prices. Keep monitoring coeprice.sg and official LTA announcements for updates on upcoming exercises.

How do I decide whether to buy now or wait for future bidding exercises?

Your decision depends on personal circumstances and market research:

If You Can Afford Current Premiums: Locking in at today’s prices ensures you secure a vehicle now, especially if you have a particular car in mind and don’t want to risk higher future premiums.

If You Can Wait and Watch: Observing one or two more bidding exercises might help you discern a trend. If prices show signs of softening, waiting could yield savings.

Economic and Policy Considerations: Keep an eye on any announcements from LTA or economic indicators that may influence vehicle affordability.

Can I renew my existing COE at these new price levels?

COE renewal is based on the Prevailing Quota Premium (PQP), which is a three-month moving average of past COE prices. While the high premiums on 18 December 2024 can influence future PQP calculations, your immediate renewal cost depends on previous months’ averages. If high premiums persist, you may face a higher PQP when your renewal date arrives.