The COE Trends in Singapore as of June 2025 show a welcome dip in premiums for Category A and B, offering cautious optimism for car buyers. In the first bidding exercise of June, COE prices for both categories fell noticeably compared to the previous round in late May.

This shift signals a potential turning point in the market, prompting questions about whether now is the right time to buy, wait, or renew. In this article, we analyse the latest COE results, what’s driving the trends, and what to expect in the coming months.

COE Premiums Drop for Cat A & B

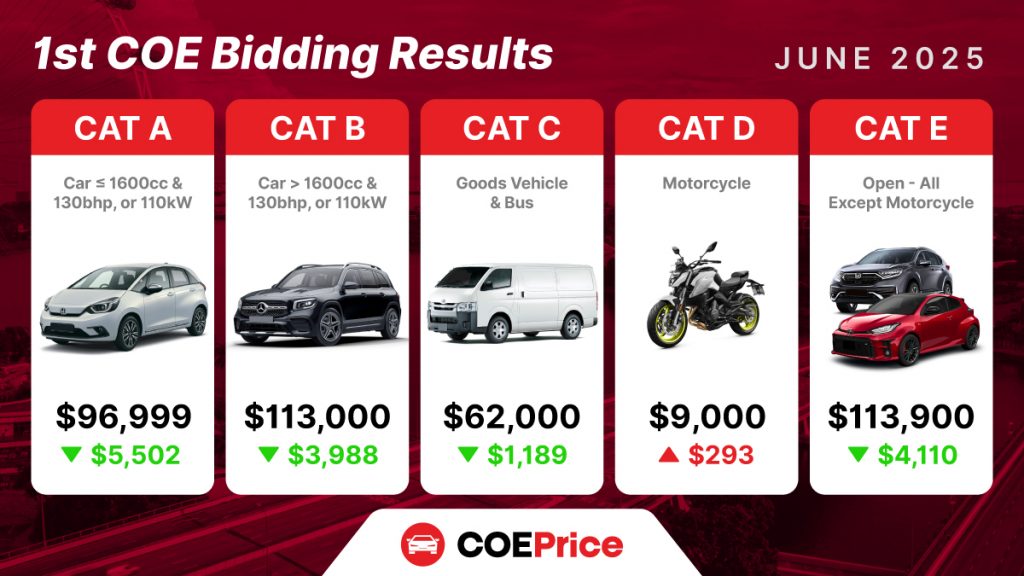

In the June 2025 1st bidding:

- Cat A closed at $96,999, down $5,502 from May’s $102,501.

- Cat B fell to $113,000, down $3,988 from $116,988.

These figures mark a return of Cat A premiums to below the psychological $100k mark and signal a stabilisation in Category B after months of elevated levels. These dips represent a meaningful reprieve for prospective car buyers.

Supply & Demand Shift

A key driver behind the price drop is the change in COE quota and bidding activity:

- Cat A quota rose slightly to 1,275 (+8), while bids fell to 1,691 (-224).

- Cat B quota increased to 795 (+13), with bids decreasing to 974 (-119).

This indicates a lower oversubscription rate and reduced bidding pressure. Increased supply, along with cautious demand from price-sensitive consumers, has created a softer bidding environment.

Why COE Prices Are Easing

Several factors are contributing to the downward trend:

- Expanded COE quota for the May–July 2025 quarter.

- Cooling buyer sentiment as six-figure COEs turn many buyers cautious.

- High PQP rates encouraging COE renewals instead of fresh purchases.

- Stabilising EV demand, especially after a surge in early 2025.

- Seasonal slowdowns, like the June school holidays.

The combination of more available COEs and a pullback in urgency among buyers is leading to this market correction.

Forecast: Cat A & B Premiums into 2026

Base Scenario: Gradual easing or stabilisation. Cat A may float between $85k–$95k, and Cat B around $105k–$115k by late 2025.

Downside Scenario: If quotas surge or economic conditions weaken, premiums could fall further—potentially into the $70k–$80k range for Cat A.

Upside Risk: If demand rebounds due to new model launches, festive buying, or stronger economic performance, premiums may rise again.

Overall, COE premiums are unlikely to return to early 2024 record highs in the near term.

Should You Buy Now or Wait?

Buy Now If:

- You need a car urgently or plan to enjoy it long-term.

- You’re comfortable with current COE prices.

- You found a good dealer promo that offsets the COE cost.

Wait If:

- You have flexibility and hope to catch lower COEs later in 2025.

- You want a 2026 registration and are not in a rush.

Timing matters, but don’t try to chase the absolute lowest price. If a COE price fits your budget, it may be the right time to act.

Renewing vs Replacing Your COE Car

Renew Your COE If:

- Your car is in good shape and meets your needs.

- You want to avoid high upfront costs of a new car.

- PQP is lower than current COE (which is now happening).

Consider Buying New If:

- Your car is costly to maintain or near end-of-life.

- You want modern features or to switch to an EV.

- COE premiums drop further and your PARF rebate helps fund a new vehicle.

Final Thoughts

The June 2025 COE results reflect a softening market, offering car buyers and current owners a chance to make smarter decisions. With COE premiums easing and supply up, the second half of 2025 presents opportunities—whether to enter the market, renew your COE at a lower PQP, or simply wait a little longer.

Stay updated, stay flexible, and assess your needs wisely. The COE tide is shifting, and with the right timing, you could catch it at just the right moment.