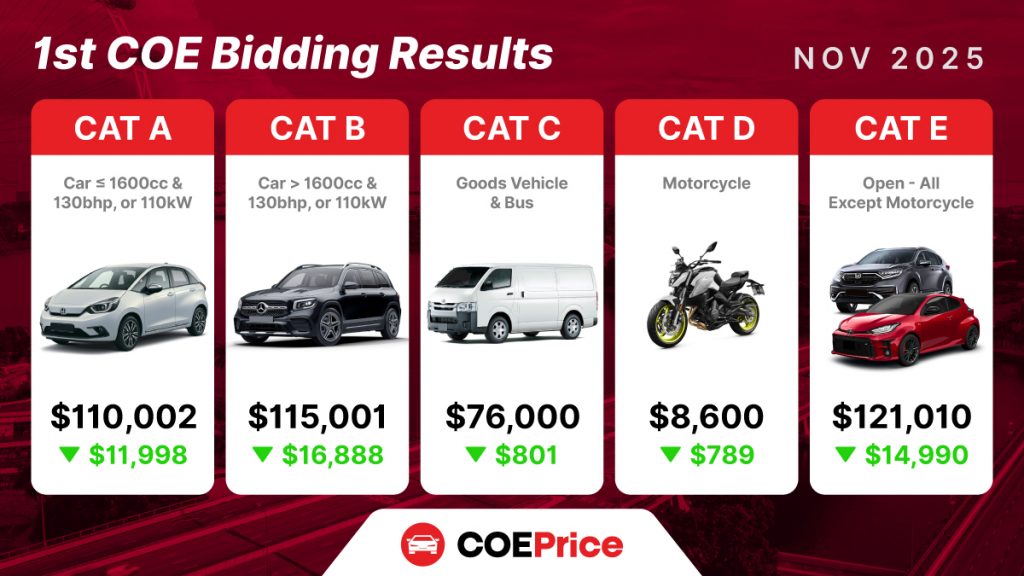

The COE Results November 2025 (1st Bidding) have been released, showing a broad decrease in premiums across most categories. This latest bidding round reflects a shift in market sentiment, where demand has moderated and quota adjustments are beginning to influence price movements.

While COE prices remain elevated compared to historical norms, the easing seen in CAT A, CAT B and CAT E suggests the market may be transitioning into a more stable phase heading into the end of the year.

Table of Contents

Summary of COE Results November 2025 (1st Bidding)

| COE Category | Quota Premium | Change vs Previous | PQP (Nov) | Quota (Change) | Bids Received (Change) |

|---|---|---|---|---|---|

| CAT A (≤1600cc & 130bhp) | $110,002 | ▼ $11,998 | $113,922 | 1,306 (+36) | 1,682 (−286) |

| CAT B (>1600cc or >130bhp) | $115,001 | ▼ $16,888 | $130,863 | 800 (−9) | 953 (−24) |

| CAT C (Goods Vehicle & Bus) | $76,000 | ▼ $801 | $72,892 | 283 (+7) | 434 (+7) |

| CAT D (Motorcycle) | $8,600 | ▼ $789 | $9,252 | 538 (+5) | 631 (+33) |

| CAT E (Open – except motorcycle) | $121,010 | ▼ $14,990 | — | 282 (+21) | 467 (+53) |

Market Analysis

1. Passenger Car Categories Are Cooling

Both CAT A and CAT B experienced some of the most significant downward movements this round.

This suggests that:

- Demand has moderated after a period of aggressive bidding

- Buyers may be adopting a wait-and-see approach due to broader economic factors

- Dealer-led bidding appears less aggressive than in previous months

Even with the decline, price levels remain historically high, which shows that underlying demand remains strong.

2. Commercial and Motorcycle Segments Remain Stable

CAT C and CAT D continue to follow a stable pattern with only slight adjustments. For CAT C, which includes goods vehicles and buses, fleet owners are pacing renewals more strategically instead of rushing into high-price bidding rounds.

This is especially relevant for companies and organisations that manage regular bus booking schedules for staff transport, shuttle services or school routes, where planning is done on a monthly or annual basis rather than responding to short-term price movements.

Meanwhile, CAT D (motorcycles) remains steady, supported by consistent everyday commuter demand. Both segments tend to reflect operational planning and long-term budgeting, making them less sensitive to short bidding fluctuations compared to private passenger car categories.

3. CAT E Shows Sensitivity to Market Confidence

CAT E — which is used by dealers for various vehicle types — saw one of the largest drops.

This suggests:

- Dealers are becoming more cautious

- There is less fear of missing supply in the near term

- The market may be in a price-discovery phase

If confidence rebounds, CAT E could rise quickly — it remains the most volatile category.

Forecast Outlook

Short-Term (Next 1–2 Bidding Cycles)

Expect sideways to slightly lower movement:

- CAT A: Likely to move within $105K–$115K

- CAT B: Likely to stabilize in $110K–$120K

- CAT E: May continue fluctuating depending on dealer strategy and year-end model launches

Dealer promotions in November–December could temporarily lift demand, but not necessarily enough to reverse the cooling trend.

Mid-Term (2026 Quota Cycles)

If COE quotas gradually increase and more vehicles deregister:

- Passenger car premiums could soften further

- CAT A is more likely to stabilize faster than CAT B due to model-mix competitiveness

- EV growth continues to influence CAT A and B as more buyers shift to lower-running-cost options

However, strong consumer appetite for cars in Singapore means prices are not likely to fall rapidly.

Long-Term Considerations

Unless the vehicle population growth policy changes:

- COE premiums are more likely to settle at a new normal rather than return to pre-2020 levels

- Structural demand (mobility, convenience, household purchasing power) remains resilient

COE corrections in Singapore tend to be gradual rather than sharp drops.

What Buyers Should Consider

| Buyer Profile | Recommendation |

|---|---|

| Upgrading / First-Time Buyers | This is a more favorable window compared to recent peaks. If the chosen model is confirmed, consider moving earlier rather than waiting for uncertain drops. |

| Renewal (PQP) | If your renewal is due soon, monitor the next bidding closely — a slight decline now could translate into meaningful PQP savings. |

| Waiting Strategy | Waiting into mid-2026 may give more stable pricing, but a dramatic price fall is unlikely. |

This round of COE results signals an important shift: the market is beginning to respond to supply adjustments and more measured bidding behaviour. While premiums remain elevated, the downward movement suggests that buyers and dealers are becoming more price-sensitive, particularly in CAT A and B.

The next few bidding cycles will provide clearer signals on whether this easing becomes a sustained trend. As policies evolve and the vehicle mix shifts further toward electric mobility, the structure of demand in each category will continue to change.

For now, the market is stabilising — but the longer-term direction will depend heavily on upcoming quota releases and consumer confidence.