The first Certificate of Entitlement (COE) bidding exercise for January 2026 has concluded, delivering a mixed set of results that defies the typical uniform trends we often see. As Singaporean drivers and dealerships gear up for the upcoming Lunar New Year festivities in mid-February, the market has split into two distinct directions: a welcome cooling in the mass-market Category A, and a continued aggressive climb in the premium Category B and Open Category E.

For prospective car buyers, these results offer a strategic window of opportunity depending on the vehicle segment you are targeting. Below, we provide a detailed construction analysis of the latest COE results January 2026 and offer an expert opinion on where the market is heading next.

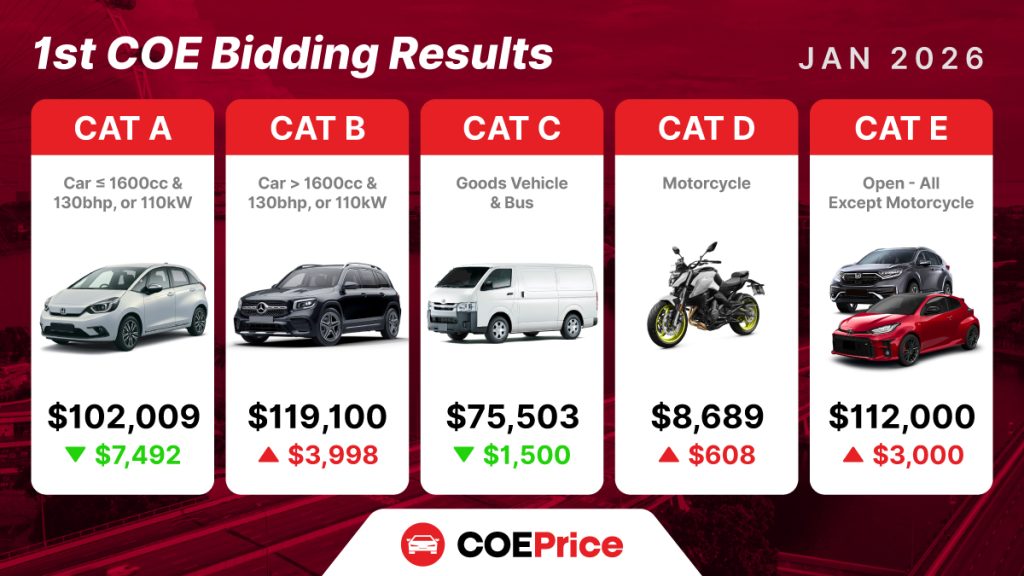

Table of COE results January 2026

The Headlines: January 2026 1st Bidding Data

The latest tender closed with significant divergence across categories. Here is the snapshot of the premiums:

- Category A (Cars ≤ 1600cc & 130bhp): $102,009 (▼ Down $7,492)

- Category B (Cars > 1600cc or 130bhp): $119,100 (▲ Up $3,998)

- Category C (Goods Vehicles & Buses): $75,503 (▼ Down $1,500)

- Category D (Motorcycles): $8,689 (▲ Up $608)

- Category E (Open Category): $122,000 (▲ Up $3,000)

(See the full table below for a comprehensive breakdown of quota vs. bids received).

Category A: A Strategic Correction or a False Dawn?

The most surprising development in this exercise is the sharp correction in Category A, which fell by nearly $7,500 to close at $102,009. After a heated end to 2025, where premiums threatened to breach historical highs, this cooling off suggests a temporary exhaustion in mass-market demand.

The drop in Cat A can be attributed to “buyer fatigue” following the December school holiday rush. Dealers likely cleared substantial inventory in the final bidding of 2025 to meet year-end sales targets. Furthermore, the quota for Cat A saw a marginal increase (up by 2 certificates), but the volume of bids received increased by only 11 compared to the previous exercise. This relatively stable demand-to-supply ratio allowed prices to soften.

However, do not mistake this for a long-term downtrend. With the PQP (Prevailing Quota Premium) for January standing at a lofty $114,004, renewing an older vehicle is currently more expensive than bidding for a fresh COE. This anomaly usually forces existing car owners back into the showroom to buy new, which inevitably pushes bid prices back up in subsequent rounds.

Category B & E: The “CNY Effect” is in Full Swing

In stark contrast to the mass market, the premium segments are accelerating. Category B premiums rose by nearly $4,000 to hit $119,100, while the Open Category (Cat E) jumped by $3,000 to settle at $122,000.

Expert Opinion: This divergence is a classic symptom of the pre-Chinese New Year (CNY) rush. With CNY 2026 falling on February 17, the clock is ticking for buyers who want their new luxury sedans or SUVs registered and delivered in time for the festive visiting period.

Luxury car buyers are typically less price-sensitive and more time-sensitive during this season. Dealerships representing premium European makes are likely aggressively bidding to secure certificates now, knowing that the next bidding exercise (January 2nd bidding) will be the absolute final cut-off for realistic pre-CNY delivery.

The widening gap between Cat A and Cat B (now approximately $17,000) also reflects the strong demand for EVs (Electric Vehicles), many of which fall into Category B due to their high power output (kW). As Singapore continues its push towards electrification, Cat B is becoming the default category for the “future-proof” car buyer, sustaining its high price floor.

Commercial Vehicles and Motorcycles

Category C (Commercial Vehicles) saw a modest dip to $75,503. This segment remains highly sensitive to business operating costs. With economic forecasts for 2026 remaining cautious, SMEs who are into bus booking services appear to be holding back on fleet expansion, leading to a softer price point.

Meanwhile, Category D (Motorcycles) continues its steady climb, rising by $608 to $8,689. While still far below the record highs of previous years, the consistent uptick suggests that demand for affordable personal mobility remains sticky, regardless of broader economic sentiment.

Expert Forecast: What to Expect for the 2nd Bidding of January?

Looking ahead to the second bidding exercise of January 2026, we anticipate high volatility.

1. The “Panic Bid” in Cat A: The $7,492 drop in Cat A is likely to be short-lived. Showrooms will use this “discount” as a major marketing hook this weekend (“COE dropped! Buy now!“). This influx of bargain hunters will likely flood the next bidding exercise with new orders, potentially erasing the savings we just saw. If you are a Cat A buyer, booking nowwhile dealers are offering rebates based on this lower COE result is a prudent move.

2. Peak Madness for Cat B: The next bidding round will be the final opportunity for guaranteed Chinese New Year delivery. Expect desperation bidding from dealers who have promised cars to customers. It would not be surprising to see Cat B and Cat E test the $125,000 resistance level in the next round.

3. The PQP Trap: Existing owners looking to renew their COEs should be cautious. The PQP is currently trailing the spot prices in Cat B but is significantly higher than the spot price in Cat A. If you drive a Cat A car, it makes little financial sense to renew right now at $114k when a new COE is $102k. This disparity will drive more scrappage and new purchases, further fueling demand for new certificates.

A Window of Opportunity

The COE results for January 2026 have started the year with a fascinating split. For the mass market, we have a brief reprieve—a “sale” of sorts. For the luxury market, the festive tax is in full effect.

Market dynamics suggest that the upcoming weeks will see aggressive sales tactics from dealers trying to clear stock before the holiday shutdown. Whether you are upgrading your family sedan or refreshing your company fleet, understanding these trends is crucial to not overpaying in a volatile market.