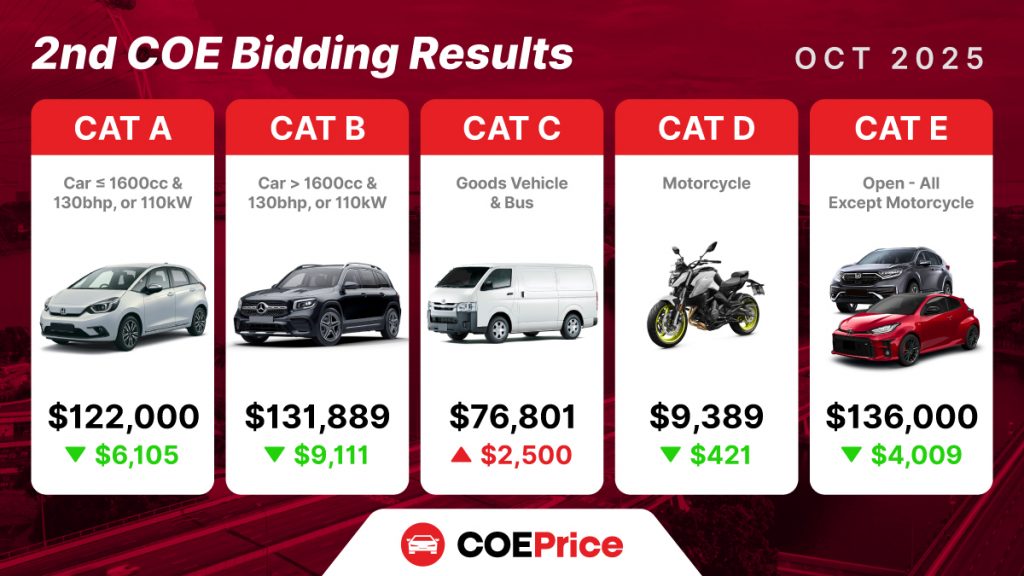

Singapore’s COE results October 2025 second bidding round brought a sigh of relief for car buyers, with most categories showing a drop in premiums after hitting record highs earlier this month.

Key COE Results Summary

- Category A (Cars ≤1600cc & ≤130bhp, or ≤110kW): $122,000 (▼ $6,105)

- Category B (Cars >1600cc or >130bhp, or >110kW): $131,889 (▼ $9,111)

- Category C (Goods Vehicles & Buses): $76,801 (▲ $2,500)

- Category D (Motorcycles): $9,389 (▼ $421)

- Category E (Open – All Except Motorcycle): $136,000 (▼ $4,009)

Market Analysis

After several months of rising premiums, the second COE bidding in October shows that demand is beginning to cool off, particularly for private car categories.

Category A & B – Cooling Demand After Highs

Both car categories saw noticeable declines. This suggests that buyer sentiment may be moderating as prices reach affordability limits. Some potential buyers could be adopting a wait-and-see approach, anticipating larger quotas or upcoming policy changes before committing to bids.

Category C – Slight Uptick in Commercial Vehicles

While private-car demand softened, commercial vehicle premiums rose slightly. This may reflect consistent demand from logistics and business operators maintaining fleet renewals despite overall market caution.

Category D – Motorcycle Prices Steady

Motorcycle premiums dipped slightly, maintaining stability over recent months. The segment remains sensitive to small quota changes, but overall demand appears balanced.

Category E – Still High But Easing

The open category, often used by luxury-car dealers, remains one of the highest at $136,000 but has edged down slightly. This mirrors the general softening in car categories and indicates that speculative demand may be tapering off.

Factors Influencing the Trend

- Quota Adjustments:

The overall quota supply remains tight but slightly higher in certain categories, providing short-term relief. - Buyer Fatigue:

After months of record-breaking COE premiums, many buyers are taking a step back, contributing to lower bid volumes. - Macroeconomic Conditions:

Slower economic growth and cautious spending habits may also be tempering aggressive bidding. - Dealer Strategies:

Some dealers could be pacing deliveries and bids strategically, awaiting potential policy clarity or new model launches before pushing demand again.

What This Means for Car Buyers

The decline in COE premiums offers a short window for those planning to purchase a new vehicle or renew their COE at a relatively lower rate. However, given the historically high base, prices remain elevated compared to pre-pandemic levels.

Outlook Ahead

Analysts expect the final quarter of 2025 to remain volatile. If deregistrations increase and quotas rise in early 2026, premiums could ease further. Still, strong demand for electric and hybrid vehicles will likely keep pressure on Category A and B prices.

For now, the latest COE results October 2025 signal a stabilising market — not a collapse, but a long-awaited pause in the relentless climb.