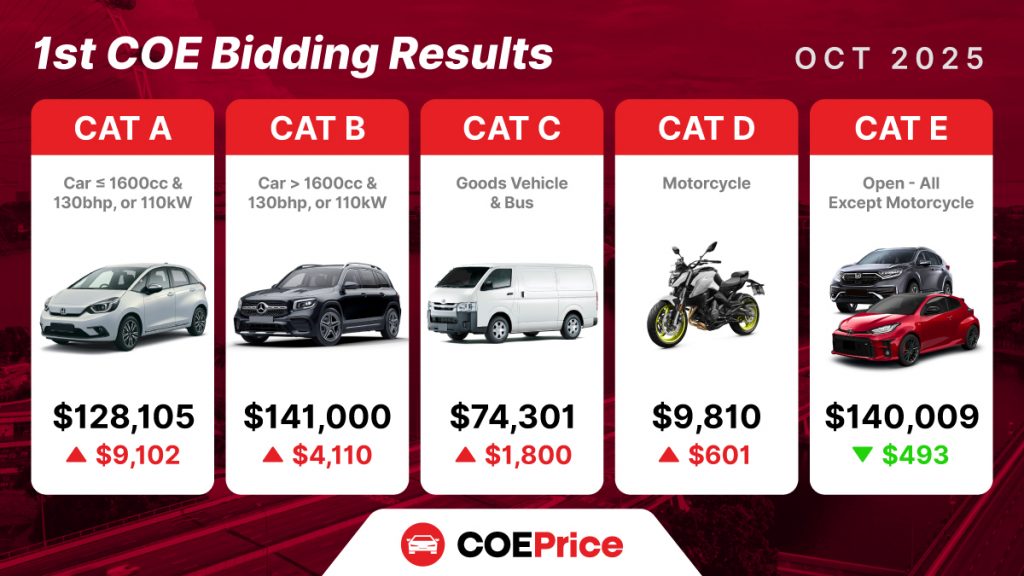

The first Certificate of Entitlement (COE) bidding exercise for October 2025 recorded another strong showing, with prices rising across nearly all categories. The continued increase underscores persistent demand for vehicles despite the already high premiums and stable supply.

Table of Content: October 2025 COE Results

Category A: Mass-Market Cars Continue to Climb

Category A, covering cars up to 1,600cc and 130bhp or 110kW, saw one of the sharpest increases in recent months. Premiums jumped by $9,102 to reach $128,105, supported by steady demand from mass-market buyers and hybrid car owners. The number of bids increased to 2,572 for a quota of 1,268, showing intense competition even as prices approach record levels.

Category B: Premium Cars Maintain Momentum

Category B, which includes larger and more powerful cars, rose by $4,110 to $141,000. The category continues to be driven by luxury and high-performance models, including a growing share of premium electric vehicles. Despite a slightly higher quota of 830, there were 1,202 bids, highlighting ongoing interest from affluent buyers and fleet operators.

Category C: Steady Growth in Commercial Vehicle Segment

Premiums for Category C, which covers goods vehicles and buses, rose modestly by $1,800 to $74,301. This increase is consistent with sustained fleet renewals from logistics companies and small business operators. The segment’s performance suggests stable underlying commercial demand even as operating costs rise.

Category D: Motorcycles Edge Upwards

Motorcycle premiums increased by $601 to $9,810, marking the third consecutive rise. While still below the $10,000 threshold, this upward movement reflects consistent demand from delivery riders and courier services. The slight gain also aligns with broader market stability across smaller vehicle categories.

Category E: Open Category Slightly Softer

The Open Category (Category E), which can be used for any vehicle type except motorcycles, was the only segment to record a marginal drop. Prices dipped by $493 to $140,009. However, the segment remains historically high as traders and dealerships continue to use it to secure certificates for premium and high-demand models.

Market Outlook

Despite small fluctuations, the broader COE market remains firmly elevated. Buyers appear undeterred by record-level premiums, as reflected by the strong bidding participation across all categories. Factors such as new model launches, private-hire vehicle renewals, and seasonal buying ahead of the year-end continue to drive activity.

Prevailing Quota Premiums (PQP) for October 2025

For vehicle owners planning to renew their existing COEs, the prevailing quota premiums (PQP) for October 2025 are:

- Category A: $105,939

- Category B: $125,165

- Category C: $70,257

- Category D: $9,202

Conclusion

The October 2025 bidding results reaffirm Singapore’s strong vehicle ownership demand despite tightening economic conditions. Unless there is a significant quota increase in the coming months, COE premiums are expected to remain high and volatile. Potential buyers and owners considering renewal are encouraged to act early to secure lower PQP rates before further adjustments.