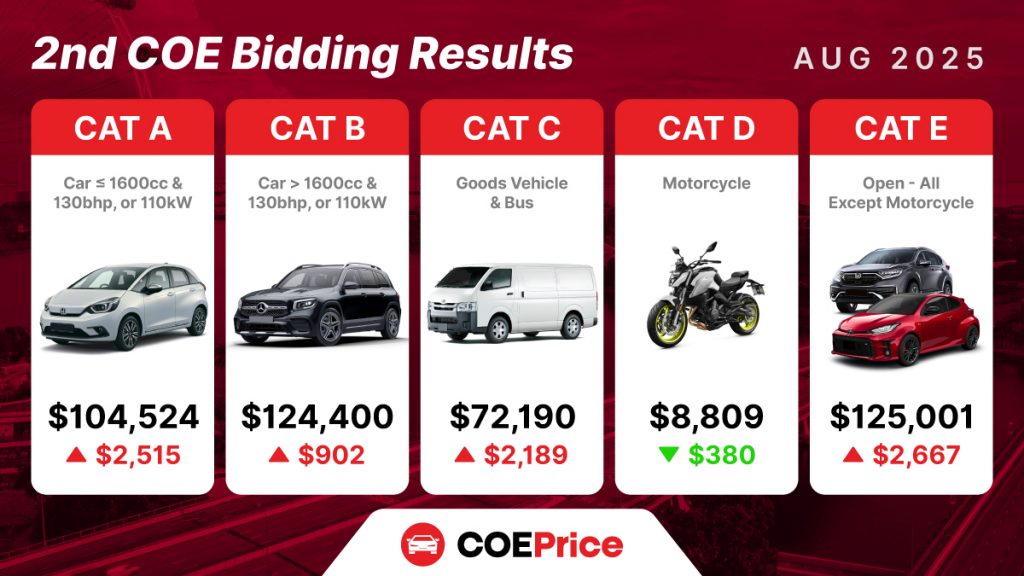

The second Certificate of Entitlement (COE) bidding exercise for August 2025 closed with mixed results across all five categories. While most categories experienced upward pressure, motorcycles saw a rare decline, offering a brief reprieve for two-wheeler buyers. The numbers reflect both strong consumer confidence and structural supply constraints that continue to shape the vehicle market in Singapore.

Table of Contents

Category A (Small Cars and EVs)

Category A premiums climbed to $104,524, representing a healthy increase of $2,515 from the previous bidding. With nearly 1,900 bids chasing just over 1,260 certificates, demand outstripped supply by a ratio of about 1.5 to 1. This shows that interest in small cars and compact electric vehicles remains strong, supported by families and first-time buyers looking for affordability within a high-cost ownership environment.

Analytically, this rise signals that even incremental supply adjustments may not be enough to tame demand. The willingness of buyers to go beyond renewal costs indicates a broader trend: compact vehicles, particularly electric, are increasingly seen as practical long-term investments.

Category B (Large Cars and EVs)

For Category B, premiums closed at $124,400, a modest rise of $902. This is the highest-priced category after the open segment, and despite its already steep cost, demand stayed firm with over 1,200 bids against 792 available certificates.

The smaller increase compared to Category A suggests a more cautious tone among buyers in the premium and luxury segment. Buyers are still willing to secure certificates at record-high levels, but the near-flat growth hints that demand may be reaching its upper ceiling. For car buyers, this could mean Category B is approaching a stabilization zone, unless new external pressures emerge.

Category C (Goods Vehicles and Buses)

Category C saw one of the sharpest moves, closing at $72,190, up $2,189 from the first bidding. This reflects about a 3.1% increase. The category recorded the highest bid-to-quota ratio, with 472 bids competing for only 273 slots.

Such a strong oversubscription reflects robust activity in the logistics, retail, and services sectors. Commercial operators are locking in capacity to expand or replace aging fleets, even at rising costs. This trend indicates confidence in business growth, suggesting that economic activity remains strong despite broader uncertainties.

Category D (Motorcycles)

In contrast, motorcycles experienced a dip, with premiums falling to $8,809, down $380. The decline reflects a healthier supply of 540 certificates against 654 bids, lowering the pressure compared to earlier this year.

This correction may be short-lived, but for now it provides a rare opportunity for riders to secure a COE at more reasonable levels. The fall suggests that the significant increase in quotas for this category has had its intended effect, cooling prices. For buyers, this is the most buyer-friendly category in the current bidding round.

Category E (Open Category)

Category E continued its upward march, surging to $125,001, an increase of $2,667. Nearly 500 bids chased just 257 available certificates, reflecting fierce competition.

The open category often reflects demand for luxury cars and large fleet operators, and this result underscores the willingness of high-end buyers to push premiums beyond Category B. Even with a quota boost this quarter, demand is still absorbing supply instantly. This is the clearest indicator of continued strength in the top-tier vehicle market.

What the Results Tell Us About the Market

The latest August 2025 2nd bid results show that Singapore’s car ownership landscape is still dominated by demand resilience. With overall premiums above $100,000 in most car categories, buyers are signaling that high costs are the new norm.

Several themes emerge:

- Robust demand across small and large cars highlights confidence in personal mobility, especially with EV adoption gaining ground.

- Commercial demand is supporting higher Category C premiums, pointing to broader economic growth.

- Luxury and open category buyers are aggressively competing, keeping premiums near record levels despite supply boosts.

- Motorcycles provide the only relief, where expanded quotas have temporarily eased pressure.

Advice for Car Buyers

For those planning to enter the market, the key takeaway is that prices are unlikely to fall significantly in the near term.

- If you are in the market for small cars or EVs (Cat A), consider moving quickly. Prices are trending upward, and waiting may cost more.

- For large cars (Cat B and E), buyers must weigh the trade-off between securing a certificate now at a record-high level or waiting to see if further quota adjustments offer relief. The risk of even higher prices remains.

- Commercial buyers (Cat C) should prepare for elevated costs as businesses compete for limited supply. Factoring these prices into operational budgets is crucial.

- Motorcycle buyers (Cat D) have a rare window of opportunity. This may be the best time in months to lock in a COE at a lower rate.

- Overall strategy: Stay informed, monitor upcoming quota announcements, and be flexible. The next round will be closely watched to see if this trend solidifies into a longer-term upward cycle.

Conclusion

The latest August 2025 2nd bid COE results underscore a market where demand continues to outpace supply in most segments. While motorcycle buyers can breathe easier, car buyers across the board should brace for persistently high premiums. For anyone considering a purchase, careful timing and strategic bidding are essential. With Singapore’s COE system continuing to reflect broader economic confidence, buyers must navigate this landscape with both prudence and decisiveness.