In this analysis of the COE August 2025 results, we break down the latest bidding prices across all categories (A, B, C, D, E) and explain what the changes mean for car buyers, along with an outlook for the months ahead. The tone is conversational yet analytical, providing insights into policy shifts, market trends, and historical context that influence the Certificate of Entitlement (COE) premiums.

Table of Contents

COE August 2025 Results: 1st Bidding

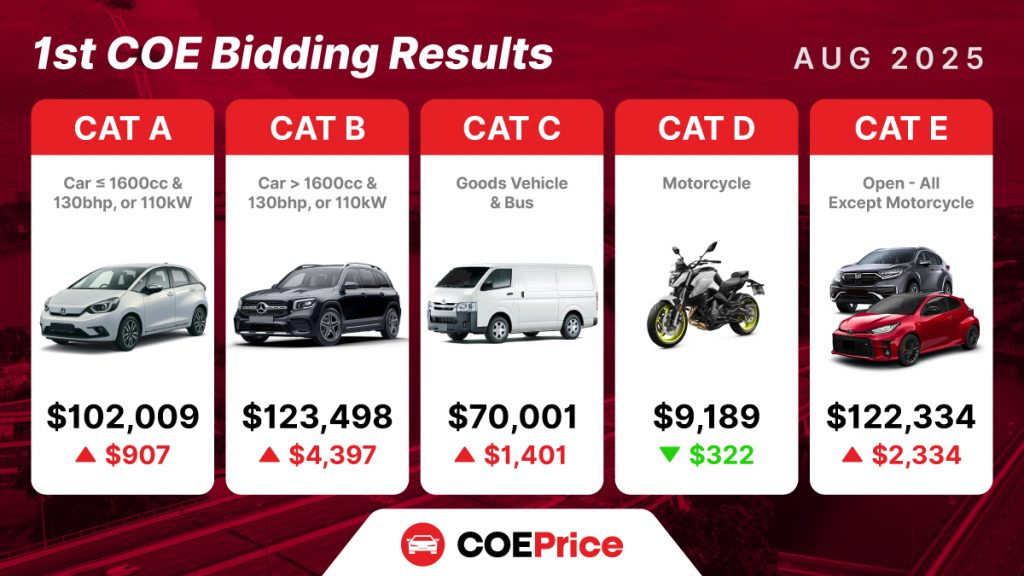

In the first COE bidding exercise of August 2025, premiums moved significantly. Prices rose for almost all categories, marking the fourth consecutive increase since June. Only motorcycle COEs saw a dip. Below is a summary of the closing premiums for each category, with their changes from the previous (late July 2025) bidding round:

- Category A (Small cars up to 1600cc / 130hp & small EVs up to 110kW): S$102,009, up S$907 from the last bid. This continues Cat A’s climb above the $100k mark.

- Category B (Large cars >1600cc or >130hp & more powerful EVs): S$123,498, up S$4,397. This jump brings Cat B to a new high for 2025 and the highest level on record so far this year.

- Category C (Commercial vehicles & buses): S$70,001, up S$1,401. Cat C remains relatively stable in the $60-70k range with a modest increase.

- Category D (Motorcycles): S$9,189, down S$322. This is a rare drop for motorcycle COEs, easing slightly from previous highs.

- Category E (Open category – usable for any vehicle except motorcycles): S$122,334, up S$2,334. Open category COEs (often used for larger cars) climbed in tandem with Cat B, staying just below Cat B’s price.

These results show car COE premiums climbing across the board, with Cat B and E leading the surge, while the motorcycle category provided a bit of relief by edging down. Premiums for regular cars (Cat A) are now firmly above the psychological S$100k threshold, and luxury car COEs (Cat B and E) are well into six-figure territory. This sustained uptrend has persisted despite efforts to increase COE supply, indicating robust demand in the market.

Quota and Demand Changes from Previous Round

One key to understanding these price movements is looking at the quota (supply of COEs) and the demand (number of bids) compared to the previous bidding. The first August 2025 tender ushered in a new quota period (Aug–Oct 2025) with a slight increase in COE availability overall. According to LTA, the total COE supply for Aug–Oct is about 2.6% higher than the last quarter (May–Jul 2025). In practical terms, this meant slightly more COEs on offer in most categories in the August 1st exercise:

- Slightly Higher COE Supply: Categories A, B, and C each had about a 1% increase in quota for this round, while Category D (motorcycles) stayed about the same, and Category E’s quota jumped significantly (by ~27%) as part of the new quarterly allocation. For example, Cat A had 1,268 COEs available, up from 1,253 in the previous round, and Cat E’s quota leapt to 261 from 211 – a sizeable boost in the open category supply. This surge in Cat E quota reflects policy moves to inject more COEs into the system (more on that later).

- Bidder Turnout: Demand, as measured by bids submitted, showed a mixed picture. In Category A, the number of bids fell to 1,755 from 1,874 in the last July tender, suggesting slightly softened demand for small cars this round (possibly as some buyers already secured their COEs in July). In contrast, Category B saw 1,271 bids, up from 1,148 previously, indicating higher interest in larger cars despite the already sky-high premiums. Categories C and D also had a bit more bidding activity (Cat C received 422 bids, up from 405; Cat D had 633 bids, up from 622). Category E demand jumped notably – 511 bids vs 431 in the last round – as dealers and individual buyers likely chased the increased supply of these flexible open COEs.

In summary, supply increased slightly, but demand in many segments remained strong or even stronger. The expanded quota was not enough to push prices down; instead, in most categories the higher quota was met with even more eager bidders. The exception was Cat A, where demand eased a touch (fewer bids) and supply was only marginally higher – that combination yielded just a small price uptick (+$907). For the other categories, heightened bidding competition drove premiums up despite more COEs available, showing that demand is currently outpacing the supply growth.

Why COE Prices Moved: Policy, Confidence, and Market Trends

Several factors help explain why COE premiums have risen the way they did in early August 2025, ranging from government policy changes to buyer psychology and broader economic trends:

- Increased COE Supply (Policy Shifts): The government has been gradually expanding COE quotas in 2025. In fact, LTA announced that the quota would rise every quarter through to an expected peak in 2026, including a plan to inject up to 20,000 additional COEs over the coming years. The August–October 2025 quota rose about 2.6% from the previous quarter due to a higher rate of vehicle deregistrations (more old cars scrapped returning COEs). Category E’s huge 27% quota jump is part of this policy to redistribute more open category certificates. Intuitively, more supply should ease prices – and indeed, these policy shifts are meant to eventually cool the market. However, in the short term the supply bump has been modest, while demand has stayed very strong. The latest tender’s outcome suggests that even a 3% overall increase in COEs wasn’t enough to satiate demand, as evidenced by rising premiums. Demand is still exceeding the (now slightly higher) supply, so prices continue climbing. The good news is that relief may be on the horizon: with COE quotas expected to keep rising into 2026, buyers could see a larger supply effect in coming quarters, potentially slowing or reversing the price trend – but that will also depend on demand factors.

- Post-Election Market Confidence: Singapore’s General Election 2025 concluded in April, and it appears to have had a notable impact on car buying sentiment. In the immediate post-election period, consumer confidence rebounded – many prospective buyers who had been holding back on big purchases earlier in the year felt assured enough to enter the market. Analysts observed a “post-GE2025” surge in buying interest, with buyers who delayed decisions before the election now rushing in to secure cars.

This was clearly seen in the May 2025 COE results, which spiked sharply just weeks after the election (Cat A breached $103k in May, a level not seen since 2023). That post-election boost has had a lingering effect through June, July, and into August. Essentially, the election removed some uncertainty and pent-up demand was unleashed – many households went ahead with car purchases, bolstered by stable political conditions. Additionally, car dealers reacted by aggressively locking in orders right after the election; showroom traffic jumped in May/June, and dealers bid strongly to secure COEs for those new orders. The latest August bidding likely still reflects this heightened demand carried over from earlier in the summer. In short, the election year dynamics contributed to an upswing in COE prices rather than the dip some hopeful buyers expected. Any “wait-and-see” buyers from H1 2025 are now in the fray, adding to competition for COEs. - Economic and Seasonal Factors: Broader economic conditions in 2025 have also kept COE demand robust. Singapore’s economy has been relatively healthy – low unemployment and accumulated savings mean many Singaporeans are still ready to splurge on cars despite record COE prices. High interest rates globally might have been expected to dampen car loans, but local interest rates have stabilized, and buyers seem to have adjusted to the higher financing costs. There is also a sense of “FOMO” (fear of missing out) among car buyers: with COE prices repeatedly breaking thresholds, some buyers feel it’s better to buy now in case prices rise even further. This mentality can create a self-fulfilling cycle, where each new high prompts more people to jump in before it gets worse. On the seasonal front, the July-August period typically might slow down due to the Hungry Ghost Month (when some avoid big-ticket purchases), but in practice it hasn’t significantly curbed car buying in recent years. Industry observers note that car sales in August don’t actually drop because of superstition – the volume largely follows the COE supply set by LTA, and recent trends show no noticeable ghost-month dip.

In 2025, any ghost-month effect is likely negligible given the strong demand momentum. We should also note the effect of mid-year promotions and new model launches: For instance, in May 2025 there was a major car expo where nearly 900 new cars were sold in two days Such events, along with attractive promotions and the introduction of new car models (especially electric vehicles), have stimulated buyer interest. Notably, popular EV models are entering the market with Category A variants (by offering lower-power versions to meet Cat A criteria) – examples include the Tesla Model Y RWD 110kW, Volvo EX30, and others now qualifying for Cat A. This expansion of choices in Cat A has likely drawn more buyers into that segment, intensifying competition for Cat A COEs. Overall, a confluence of solid economic footing, consumer optimism, and new product offerings has kept demand high even as we enter the typically slower season.

In essence, policy changes are increasing supply, but demand fueled by post-election confidence and other factors is currently outstripping those gains. Car buyers, buoyed by a stable economy and perhaps a sense that “now is the time” (either for fear of future price hikes or thanks to new model availability), continue to bid enthusiastically. This is why we’re seeing COE prices still rising in August 2025 despite more COEs being gradually added to the system.

What This Means for Car Buyers: Trends and Timing

For prospective car buyers, the August 2025 COE outcome carries several implications:

- Continued High Prices in the Near Term: COE premiums are near historical highs and have shown an upward momentum over the past few months. The fact that Cat A and Cat B premiums have breached the $100k and $120k marks respectively means buying a car now requires a significantly larger budget than a year ago. If you’re planning to purchase a car soon, expect to pay top dollar for the COE portion. Dealers will inevitably pass these costs on in the form of higher vehicle prices. There is also a psychological element at play – with Cat A crossing $100k, some buyers may panic and rush in (to “buy before it gets even higher”), which could keep prices elevated in the immediate next bidding or two. As a buyer, try not to get caught up in this panic if you can avoid it. Assess your needs calmly: if you can wait a few months, it might be worth watching if prices stabilize or pull back slightly after this steep run-up.

- Monitor Supply Injections and Policy Announcements: On the positive side, the supply of COEs is slated to keep rising quarter-on-quarter through 2025 and into 2026, as LTA responds to public concerns over affordability. More COEs in the system should eventually put downward pressure on prices – or at least cap further increases – provided demand doesn’t escalate equally fast. Keep an eye on the next quota announcement (for November 2025 to January 2026) which will be released in October. If there’s another increase in quota (which is likely, given the continuing wave of vehicle deregistrations from 10-year-old cars), premiums might start to level off. In addition, any government policy tweak – for example, adjustments in vehicle taxes or financing rules – could influence demand. Thus far in 2025, measures like the additional COE injections have been incremental, but a major policy change (say, raising the vehicle growth rate or other cooling measures) could shift the market. Car buyers should stay informed on LTA announcements, as these will guide the supply side of the equation.

- Timing Your Purchase: Deciding when to jump in is tricky. If you need a car urgently, there’s little choice but to bite the bullet and pay the prevailing rate. In that case, it pays to shop around different dealers; some may have forward-booked COEs or packages that can buffer you slightly from sudden spikes. For those with more flexibility, note that COE prices are cyclical over the long term. We may be nearing the peak of the cycle with record premiums – historically, such peaks are followed by corrections as more COEs become available (for instance, the mid-2010s saw COEs fall after a high period when a large batch of cars were deregistered). With the quota expected to peak in 2026, many analysts anticipate that COE prices could moderate in late 2025 or 2026. This suggests that if you can delay your purchase for another year or so, you might stand a better chance of securing a cheaper COE when supply is much higher. However, this is not guaranteed – if demand remains red-hot or if there are new sources of demand (e.g. ride-hailing fleets expanding, etc.), prices could stay high. Another timing consideration: the “Hungry Ghost” month (Aug 23–Sep 21, 2025), which some think could lower demand. In practice, as noted, it hasn’t made a big dent in recent years, but it will be interesting to see if the second August bidding (closing late Aug) experiences any dip in participation. A minor lull could present a short window where premiums settle slightly, though by the October bidding we’ll be into the year-end period where demand sometimes picks up again (people buying cars before new year or before any tax changes in the next budget).

- Budgeting and Alternatives: Car buyers should budget conservatively given these COE prices – remember that the COE is only part of the total car cost (which also includes the vehicle price, taxes like ARF, insurance, etc.). A S$120k COE can often represent over half the price of a mass-market car now. Ensure you’re not overstretching finances to purchase a car in this climate of expensive COEs. Consider alternatives: if owning a car isn’t absolutely necessary right now, you might opt for leasing or using car-sharing services in the interim while waiting for COE prices to soften. For those eyeing Category D (motorcycles), the slight dip to $9.1k is a welcome relief, and there’s hope that upcoming government measures (like allowing COE renewal in installments for bikes) could further temper motorcycle COE prices – something to watch if you’re a rider. On the other hand, electric vehicle incentives (like the EV Early Adoption Incentive and revised road tax structures) might spur more people to go for EVs, which could keep Cat A and B demand high. If you are specifically looking for an EV, note which category it falls in; some new EV models have been engineered to fit in Cat A, making them attractive buys but also adding pressure to Cat A COE.

- Negotiating with Dealers: In this sellers’ market, dealers know COEs are pricey. Some dealers offer packages with “COE confidence” (they secure the COE for you at a capped fee). It may be worth exploring those, but read the fine print – in many cases the customer ultimately bears the COE cost. If COE prices do start to drop later, dealers might be slow to lower car prices accordingly (they may pocket some margin). Conversely, if you secure a COE now and prices fall substantially next year, there’s no refund – that’s the risk you take. So, think long term: if the plan is to own the car for 5-10 years, a few tens of thousands difference in COE now averaged over the ownership period may be acceptable. But if you’re the type who might change cars in a couple of years, buying at a peak COE could mean a big financial hit (as the remaining COE value is part of the resale).

In summary, car buyers should approach the current market with caution and awareness. The trend from the August 2025 1st bidding suggests high prices will persist in the short term, but increasing supply and historical cycles hint at a possible easing later on.

Stay alert to market updates, consider if you can wait for a better window, and if you do proceed, make sure to account for the hefty COE cost in your overall car budget. The key is not to panic buy, but to make an informed decision based on your personal need and financial comfort.

COE Prices Now vs a Year Ago: Historical Context

It’s helpful to put the current COE prices in perspective. How do August 2025 premiums compare to last year’s levels?The short answer: they are significantly higher for car categories, continuing an upward trajectory that has been in play for the past couple of years.

In August 2024 (1st bidding), the COE prices were considerably lower for most categories: Cat A was around S$94,289, Cat B about S$106,101, and Cat E roughly S$105,239. Those were already historically high at the time, but in the span of one year, Cat A has climbed by about 8% (now $102k+ from $94k) and Cat B by around 16% (now $123k+ vs $106k) – a huge year-on-year jump.

The Open category (E) similarly is up about 16% from around $105k to $122k. This means that an average mid-range car that cost, say, $150,000 with COE last year might cost well over $160,000 today simply due to the higher COE.

Interestingly, not every category is up versus last year. Category C (goods vehicles) at this time last year was around $71k, which is actually slightly higher than the $70k seen now – suggesting that commercial vehicle COEs have stayed flat or even dipped year-on-year. This could be due to earlier spikes in Cat C that have since cooled, or because businesses are sensitive to costs and adjusted their fleet renewal timing.

Category D (motorcycles) is also slightly down from the ~$9.6k level a year ago to about $9.2k now. Motorcycle COEs had shot up dramatically in 2022–2023 (crossing $10k at one point), so the fact that it’s lower now than a year ago hints that measures to stabilize motorcycle COEs (and perhaps softer demand from high prices) are having some effect.

From a historical high standpoint, the current Cat B and Cat E premiums in the $120k+ range are among the highest COE prices ever recorded in Singapore. We’ve effectively surpassed the peaks seen in the 2010s. For instance, back in 2013, COEs hit around $90k; in late 2021 and 2022, records were continually broken as prices went past $100k. Now in 2025, we are in uncharted territory above $120k for some categories.

This raises the question of sustainability – historically, such high levels tend to be followed by policy intervention or natural correction (as more COEs flood in from deregistrations). Indeed, as noted, a wave of deregistrations is expected by 2025-2026 (many cars registered during 2015-2017 will be expiring), which is why LTA is projecting larger quotas moving forward.

If we look at the big picture of COE cycles, the last major peak was around 2011-2013, followed by a significant drop in 2014-2015 when quotas expanded. We are now in another peak phase. If history repeats, we could see these record-high prices eventually come down as supply catches up.

However, one difference now is the sheer number of wealthier buyers (and entities like private hire fleets) in the market, which wasn’t as large a factor a decade ago. This demand side has grown, potentially keeping the equilibrium price high.

For a car buyer in 2025, knowing that today’s COE premiums are about 10-20% higher than a year ago and at or near all-time highs should underscore caution. It’s a reminder that we are likely near the top of the cycle – though pinpointing the exact peak is impossible except in hindsight. If you felt last year’s COEs were expensive (and they were), this year has only amplified that further.

The historical context also highlights that COE prices are volatile and cyclical; a year from now, we could be having a very different conversation if an oversupply of COEs causes premiums to dip. On the other hand, if demand remains unabated, we might see new highs.

Always factor in a buffer in your car purchase budget to account for these swings. And remember, a COE gives the right to own a vehicle for 10 years – some relief can be found in spreading the cost mentally: a $120k COE equates to $12k per year of car ownership (not including the car’s cost). Still steep, but important to consider in context of usage and time.

In conclusion, the 1st bidding exercise of August 2025 delivered record or near-record COE prices for Singapore’s car buyers, despite a slight increase in COE quotas. The results across Categories A, B, C, D, and E show a market that is supply-constrained and demand-driven, fueled by post-election confidence, a robust economy, and buyers’ eagerness to secure vehicles even at eye-watering costs.

For consumers, it’s a challenging environment – one that calls for careful planning, maybe some patience for potential future relief, and a clear understanding of how these premiums fit into one’s overall financial picture.

The coming months will be critical to watch: if quotas continue to rise (as planned) and demand eventually cools, we may finally see these relentless price increases start to stabilize or reverse. Until then, anyone in the market for a car should stay informed and weigh their options prudently.

The COE August 2025 results encapsulate the state of Singapore’s car market: expensive and competitive, but not without hope on the horizon that saner prices will prevail as the cycle turns.