The COE trend May 2025 reflects a slight dip in premiums during the second bidding exercise, following a post-election surge earlier in the month. While prices eased across most categories, COE levels remain historically high, keeping car ownership costly in Singapore.

For car buyers, the latest results offer both insight into shifting demand and a potential window for strategic decision-making.

Table of Contents

Category Breakdown: May 2025 COE 2nd Bidding Results

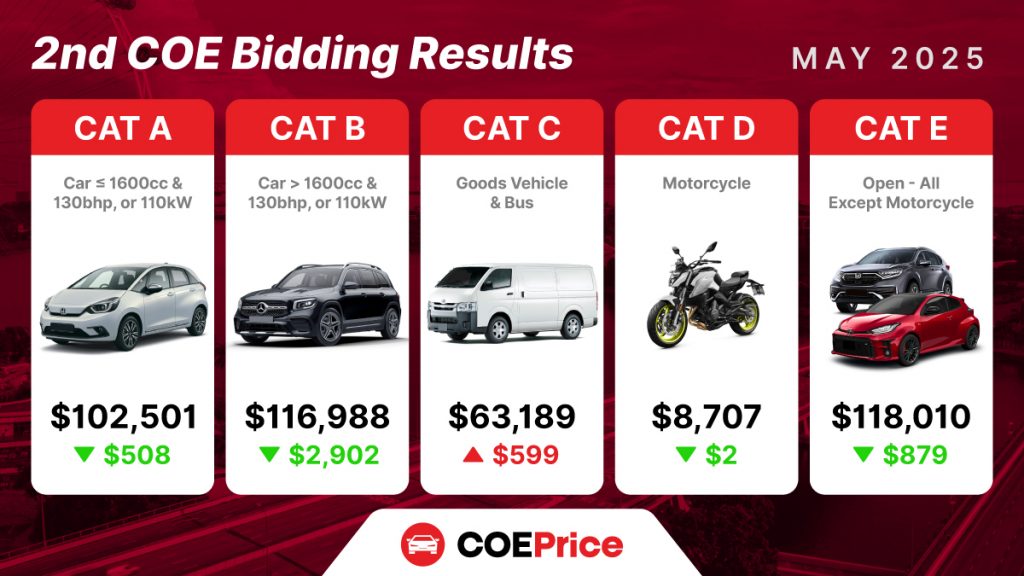

In the May 2025 second COE tender, premiums slipped in four out of five categories. Below is a breakdown of each category’s closing price and how it changed from the first bidding in early May:

- Category A (Cars ≤1600cc & 130bhp, or EV ≤110kW): $102,501, down by $508. This slight dip brings Cat A just under its earlier 30-week high, but it remains above the $100k mark.

- Category B (Cars >1600cc or 130bhp, or EV >110kW): $116,988, down by $2,902. This was the most significant drop among car categories, though Cat B is still well above its recent averages.

- Category C (Goods vehicles & buses): $63,189, up by $599. The only category to rise this round, Cat C’s premium ticked up about 1%.

- Category D (Motorcycles): $8,707, essentially unchanged (down $2). Motorcycle COEs stayed flat, hovering around the mid-$8k range.

- Category E (Open Category – usable for any vehicle except motorcycles): $118,010, down by $879. Open category premiums dipped slightly and continue to track Category B closely.

In early May, right after Singapore’s General Election 2025, COE prices had surged. Cat A breached $103k – its highest since 2023 – and Cat B and E also climbed to around $119k and $118.9k respectively. The second bidding’s slight declines in Cat A, B, and E indicate a minor correction from those peaks. Meanwhile, Cat C’s increase in late May recovers some of its earlier drop. In short, after the post-election rally in the first round, the market has cooled marginally across most categories, though COE premiums are still extremely high across the board.

What’s Driving the Price Movements?

Multiple factors are influencing the COE trend in May 2025. Industry analysts point to a mix of post-election buying momentum and seasonal events that boosted demand earlier in the month, followed by a slight tapering off:

- Post-GE2025 Confidence: Singapore’s General Election concluded in late April. Many buyers who had held off purchases jumped back in afterward. Market confidence returned quickly post-election, fueling more aggressive bidding in early May.

- The Car Expo Effect: A major car show (The Cars@Expo 2025) took place over the election weekend, generating a surge of showroom traffic and new orders. Dealers report that robust sales from the expo translated into higher COE demand in the first May bidding. By the second bidding (after the Expo ended), this pent-up demand had somewhat dissipated, leading to fewer bids.

- Increased COE Supply, But Still Tight: The government has been gradually raising COE quotas. For the May–July 2025 period, the total COE supply is about 6% higher than the previous quarter and 21% higher year-on-year. However, demand is still outpacing supply. The second May exercise received over 4,400 bids for just over 3,000 available COEs – an oversubscription that kept premiums high.

- EV Expansion Crowding Cat A: More electric vehicles now qualify as Category A, such as Tesla Model Y and new Chinese EVs. This has created fierce competition for Cat A, sustaining prices above $100k despite slight dips in demand.

- Economic Factors: Strong local demand, rising household incomes, and a wave of 10-year-old car replacements from 2015–2016 are also key drivers. Many car owners are choosing to upgrade now, especially with attractive new EV offerings.

In summary, robust demand – driven by post-election confidence, a successful car expo, more EV options, and a wave of replacements – is meeting only modestly higher supply, resulting in only a slight moderation in prices.

Should Car Buyers Buy Now or Wait?

With COE premiums still near historic highs, many prospective car owners are wondering whether to commit now or hold off. Here’s a breakdown:

Buying Now:

If you need a car in the immediate future, expect to budget for a COE above $100k for Category A and $117k for Category B – on top of the car price. While expensive, locking in now ensures you get a COE before any further policy or market changes. Prices could climb again if demand rebounds quickly.

Waiting It Out:

There are signs that patience may pay off. The government has increased quotas, and some market fatigue is visible. If the next few exercises continue showing slight dips, premiums could gradually fall. Monitoring the next bidding cycles will be key.

Practical tip: Consider renewing your existing COE or purchasing a used car. The Prevailing Quota Premium (PQP) for Cat A in May was about $93.7k – lower than bidding for a new COE. This option avoids the volatility of fresh bids while keeping your car.

Outlook: What’s Next for COE Prices?

Looking ahead, COE premiums are expected to remain high but may gradually ease. The next bidding in early June will signal whether the recent dip continues or if prices stabilize. Some dealers believe prices will soften with increased quotas and buyer fatigue. Others warn that COEs at $100k+ may become the new norm.

Unless there is a major economic shift or policy overhaul, premiums are likely to stay elevated. The upcoming quota announcements and deregistration trends will play a big role in shaping the second half of 2025.

Conclusion

The COE trend in May 2025 shows a market that may have peaked but isn’t falling sharply. For car buyers, the decision to buy now or wait hinges on urgency, financial readiness, and risk tolerance. Keep a close eye on upcoming bidding results, policy updates, and market sentiment. While prices are high, a small window of relief could be on the horizon.