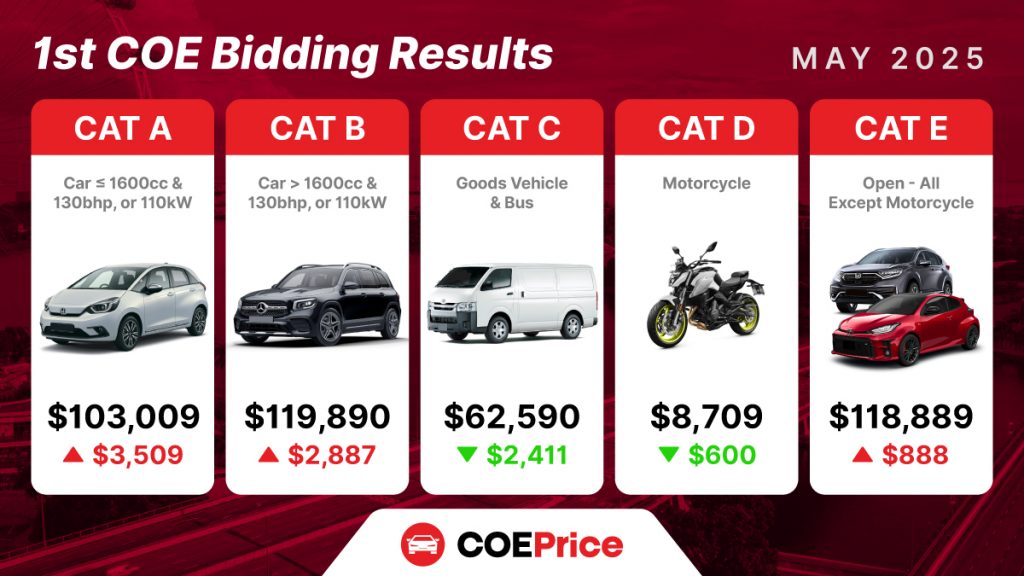

The May 2025 COE Results (1st Bidding) concluded with mixed movements across categories, marked by significant spikes in Category A and B premiums. This uptick reflects evolving buyer sentiment, intensified by strong post-motor show demand and limited quota adjustments. Coming on the heels of Singapore’s 2025 General Election—where the PAP retained a strong majority—policy continuity was affirmed, with little immediate effect on COE structures.

Category A climbed to $103,009 and Category B soared to $119,890, reinforcing how economic conditions and demand cycles, rather than political shifts, remain the key COE price drivers.

Analysis of May 2025 COE Results

Category A (Cars ≤1600cc & 130bhp or 110kW)

- Quota Premium: $103,009

- Change: ▲ $3,509

- Quota: 1,267 (+128)

- Bids Received: 2,240 (+119)

- PQP (May): $93,718

Category A saw a significant upward adjustment, breaking past the $100,000 threshold once again. Despite a 9% increase in quota, strong bidding activity indicates that demand remains resilient among mass-market car buyers, possibly fuelled by preemptive buying before potential regulatory shifts.

Category B (Cars >1600cc or 130bhp, or 110kW)

- Quota Premium: $119,890

- Change: ▲ $2,887

- Quota: 813 (+69)

- Bids Received: 1,210 (−788)

- PQP (May): $114,249

Luxury and high-performance cars under Category B also saw a price spike, albeit with fewer bids compared to April. This may suggest buyers are becoming more selective or are pausing in anticipation of better deals. Still, with COE prices nearing $120,000, competition remains intense.

Category C (Goods Vehicle & Bus)

- Quota Premium: $62,590

- Change: ▼ $2,411

- Quota: 271 (+11)

- Bids Received: 386 (−13)

- PQP (May): $66,428

COE premiums for commercial vehicles dipped as demand softened slightly. This could reflect the challenging business climate, with companies holding off fleet upgrades due to rising operational costs.

Category D (Motorcycles)

- Quota Premium: $8,709

- Change: ▼ $600

- Quota: 536 (+17)

- Bids Received: 676 (+16)

- PQP (May): $9,165

Motorcycle COE prices dropped modestly, showing relative price stability despite consistent bidding numbers. This category continues to attract interest from delivery riders and cost-conscious commuters.

Category E (Open – All Except Motorcycle)

- Quota Premium: $118,889

- Change: ▲ $888

- Quota: 207 (+7)

- Bids Received: 384 (−22)

- PQP: Not Applicable

Category E continues to serve as a wildcard for luxury and high-demand buyers, remaining closely aligned with Category B. Its steady premium increase reflects buyer spillover from other car categories and speculation on future COE trends.

Key Takeaways

- Passenger car COEs (Cat A & B) continue to rise sharply despite increased quota—demand remains strong.

- Commercial and motorcycle categories saw small declines or stability, indicating cautious business sentiment.

- Total quota increases across most categories have not significantly cooled prices, showing that pent-up demand still dominates.

Final Thoughts

With COE prices for cars breaching six figures again, buyers may need to rethink vehicle ownership timelines or explore alternatives such as leasing or public transport. As Singapore continues to regulate car population through its COE system, staying updated with each bidding exercise is critical for informed decision-making.

Stay tuned for the 2nd bidding of May 2025.