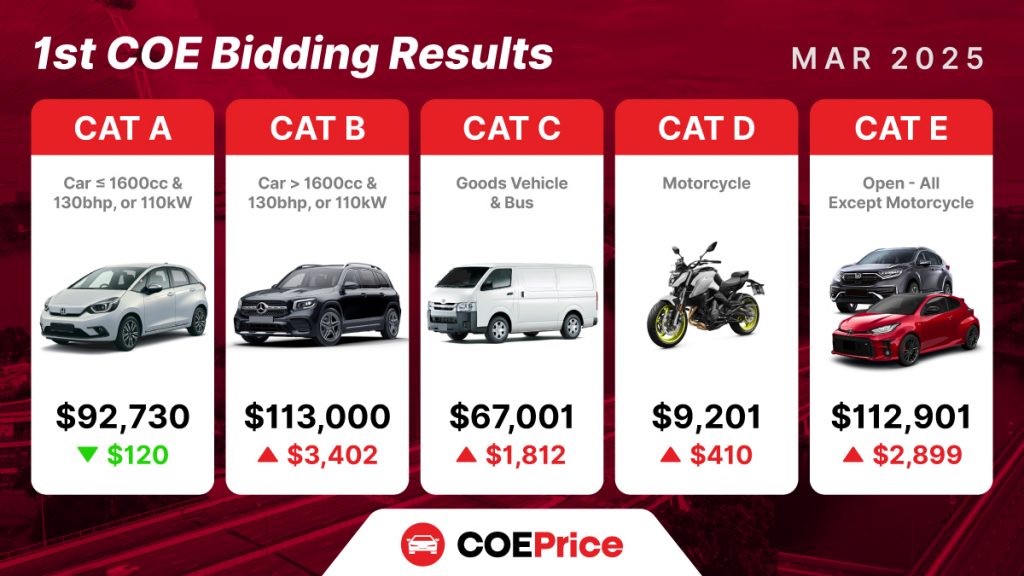

The most recent COE bidding results, for March 2025 – 1st Bidding, closed on Wednesday, March 5, 2025, provide a snapshot of current market dynamics.

Table of Latest COE Results

Below is a detailed breakdown of the results, including Quota Premiums, changes from the previous bidding, Prevailing Quota Premium (PQP), quotas, and bids received for each category:

| COE Category | Quota Premium | Change | PQP | Quota | Bids Received |

|---|---|---|---|---|---|

| CAT A: Cars ≤ 1600cc & 130bhp, or 110kW | $92,730 | ▼ $120 | $92,525 (Mar) | 1,144 (-5) | 2,034 (-256) |

| CAT B: Cars > 1600cc or 130bhp, or 110kW | $113,000 | ▲ $3,402 | $111,807 (Mar) | 765 (+21) | 1,208 (+73) |

| CAT C: Goods Vehicle & Bus | $67,001 | ▲ $1,812 | $66,874 (Mar) | 262 (+3) | 413 (-17) |

| CAT D: Motorcycle | $9,201 | ▲ $410 | $8,344 (Mar) | 519 (-5) | 624 (-21) |

| CAT E: Open-All Except Motorcycle | $112,901 | ▲ $2,899 | – | 202 (+4) | 403 (+36) |

Analysis of Results:

- CAT A: The Quota Premium decreased by $120 to $92,730, with a quota reduction of 5 to 1,144 and a significant drop in bids received (2,034, down 256). This suggests a potential stabilization or slight decrease in demand for smaller cars, possibly due to economic factors or preference for alternatives like ride-sharing.

- CAT B: A notable increase in Quota Premium by $3,402 to $113,000, with quota up by 21 to 765 and bids received increasing by 73 to 1,208, indicates strong demand for larger or more powerful cars, likely driven by affluent buyers and economic growth.

- CAT C: The Quota Premium rose by $1,812 to $67,001, despite a slight quota increase of 3 to 262 and fewer bids received (413, down 17). This suggests that commercial vehicle demand remains robust, with higher bids compensating for lower participation.

- CAT D: Motorcycle COE prices increased by $410 to $9,201, with a quota decrease of 5 to 519 and fewer bids (624, down 21), indicating a stable but slightly tightening market for motorcycles.

- CAT E: The open category saw a significant Quota Premium increase of $2,899 to $112,901, with quota up by 4 to 202 and bids received increasing by 36 to 403, reflecting strong demand for flexible vehicle options.

These results highlight a mixed trend, with smaller cars (CAT A) seeing a rare price decrease, while larger cars (CAT B) and the open category (CAT E) experience significant price hikes, reflecting diverse market pressures.

Factors Influencing COE Bidding Trends

Several factors contribute to these trends:

- Economic Conditions: Singapore’s strong economy, with a high GDP per capita, supports demand for cars, especially larger models. Recent reports indicate a stable economic environment, with growth in disposable income potentially fueling CAT B and E price increases.

- Government Policies: The Land Transport Authority (LTA) manages COE quotas to control vehicle population, with recent adjustments affecting supply. For example, quota cuts in previous years have led to higher prices, and the current data shows mixed quota changes (e.g., CAT A down 5, CAT B up 21), influencing competition.

- Alternative Transportation: The rise of ride-sharing services like Grab and Gojek, coupled with efficient public transport, may reduce demand for smaller cars (CAT A), as seen in the drop in bids received.

- Multiple Car Ownership: Only 15% of car-owning households have more than one car, suggesting limited multiple ownership, which might constrain overall demand but not affect high-end categories like CAT B and E.

Implications for Car Buyers and the Market

The latest trends indicate that potential car buyers, especially for smaller cars, might find a slight relief in CAT A prices, but larger cars and open category vehicles remain expensive, with CAT B and E exceeding $112,000. This high cost, combined with taxes and import duties, makes car ownership in Singapore one of the most expensive globally. Buyers should stay informed about bidding dates and trends, using resources like COE Prices & Latest Bidding Results to strategize their bids.

Looking forward, if economic conditions remain stable and quotas continue to be managed tightly, COE prices for CAT B and E may persist at high levels, while CAT A could see further stabilization or slight decreases, depending on demand shifts towards public transport.

Conclusion

Singapore’s latest COE bidding trends for March 2025 – 1st Bidding reveal a complex market, with CAT A showing a rare price drop, while CAT B, C, D, and E experience increases, driven by strong demand for larger and commercial vehicles. Economic stability, government policies, and alternative transport options shape these dynamics, urging potential buyers to stay informed and strategic in their bidding decisions.