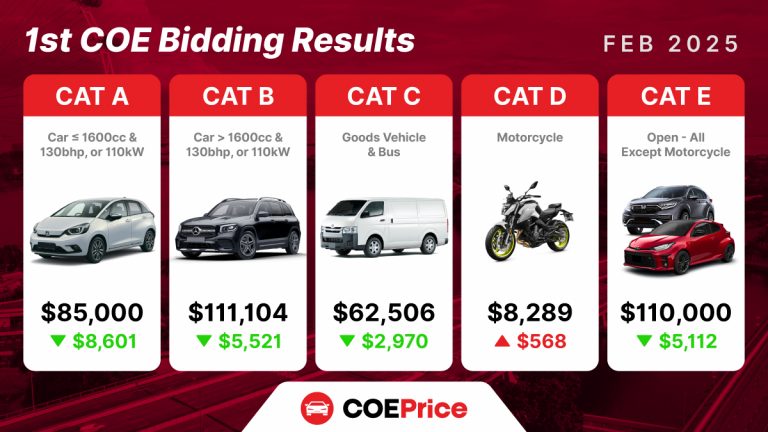

The results from the February 2025 1st COE bidding exercise reflect notable trends and shifts across all categories when compared to the 2nd bidding exercise in January 2025. Here’s an in-depth comparison and analysis of the changes observed.

Below is a breakdown of the February 2025 1st COE Bidding results and trends:

Table of Contents for February 2025 1st COE Bidding

1. COE Price Changes by Category

- Category A (Cars ≤ 1600cc & 130bhp, or 110kW):

- February 2025: $85,000

- January 2025: $93,601

- Change: Decrease of $8,601

- Insight: This steep decline suggests that buyers may be exercising caution or shifting preferences amid broader market uncertainties. The increased quota (+69 units) in this segment likely contributed to softer demand, as the higher supply reduces bidding competition.

- Category B (Cars > 1600cc or 130bhp, or 110kW):

- February 2025: $111,104

- January 2025: $116,625

- Change: Decrease of $5,521

- Insight: Although the reduction here is less pronounced than in CAT A, it indicates a moderated demand likely influenced by a combination of buyer sentiment and improved supply conditions (quota increased by 62). This suggests that while buyers remain interested in larger, more powerful cars, the easing of competitive pressure is beginning to temper prices.

- Category C (Goods Vehicles & Buses):

- February 2025: $62,506

- January 2025: $65,476

- Change: Decrease of $2,970

- Insight: The smaller drop in this category points to relatively stable demand in the commercial vehicle segment. The quota increase of 26 units might have been sufficient to ease bidding pressures slightly without drastically undermining market interest, reflecting a balanced dynamic between supply and steady operational needs.

- Category D (Motorcycles):

- February 2025: $8,289

- January 2025: $7,721

- Change: Increase of $568

- Insight: This unique uptick indicates robust demand in the motorcycle segment, even as the quota decreased by 12 units. The rise in premiums could be attributed to a niche market shift—possibly as buyers turn to motorcycles for cost-effective mobility in a challenging economic environment or due to changing consumer preferences.

- Category E (Open Category):

- February 2025: $110,000

- January 2025: $115,112

- Change: Decrease of $5,112

- Insight: As a catch-all category, the price drop here mirrors the general market trend observed in passenger vehicles. The modest increase in quota (+9 units) further suggests that while supply is increasing, overall demand is not strong enough to maintain previous premium levels, reflecting cautious buyer behaviour.

2. Quota Adjustments

Across most categories, there was an increase in quotas:

- Category A: Increased by 69 to 1,138

- Category B: Increased by 62 to 748

- Category C: Increased by 26 to 260

- Category D: Decreased by 12 to 524

- Category E: Increased by 9 to 199

The increased quotas contributed to the price declines in most categories, as the higher supply helped to ease competitive bidding pressure.

3. Bid Volume Trends

Bid volumes showed mixed trends:

- Decreases: Categories A and B saw fewer bids (-38 and -64 respectively), likely due to buyer caution amid economic factors.

- Increases: Categories C, D, and E saw more bids (+21, +67, and +43 respectively), suggesting heightened interest, especially in the motorcycle segment.

4. Prevailing Quota Premium (PQP) Comparison

- Category A PQP: Dropped from $97,747 (Jan) to $94,513 (Feb)

- Category B PQP: Increased slightly from $109,164 (Jan) to $110,537 (Feb)

- Category C PQP: Decreased from $70,912 (Jan) to $68,481 (Feb)

- Category D PQP: Decreased from $8,935 (Jan) to $8,457 (Feb)

The adjustments in PQP reflect the broader price trends, with slight variations across categories.

February 2025 COE bidding results analysis

The February 2025 COE bidding results indicate a general downward trend in COE prices, driven by increased quotas and shifting demand dynamics. Categories A, B, and E saw significant price drops, while motorcycles in Category D experienced a rare price increase, hinting at specific demand growth. As the year progresses, further fluctuations are expected based on economic conditions, regulatory changes, and consumer sentiment.